Maryland ABLE March Newsletter

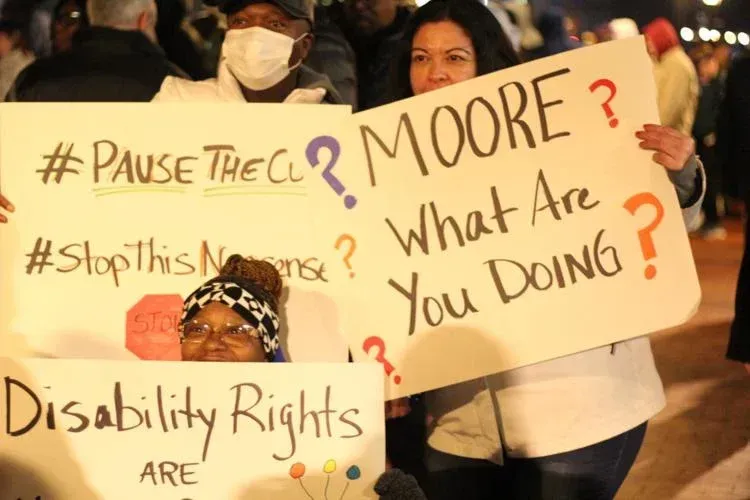

An Update on the Maryland ABLE Program

Though 2020 was a challenging year for all, the MD ABLE program continued to grow. Maryland ABLE provided a way for Account Holders to protect their assets and continue their eligibility for means-tested programs including SSI, SSDI, Medicaid, and HUD.

At the end of 2020, Maryland ABLE had increased the number of beneficiaries by 52% over the 12-month period and total assets in the plan more than doubled over the year! The year end assets totaling $24.4 million included standard contributions, ABLE to Work contributions totaling almost $700.000, over $1.5 million from 529 College Savings Plan rollovers, investment income, and over $1.8 million in gifts from family members and friends. The Program has continued to grow throughout the start of 2021. As of February 17th there were 2,885 account owners and over $27.2 million in assets in the Maryland ABLE Plan.

A new addition in 2020 was the Maryland ABLE’s Entity Authorized Legal Representative (“ALR”) process. This has provided Maryland agencies that serve as Social Security Representative Payees the opportunity to streamline their enrollment paperwork and management for multiple accounts. By the end of the year there were 15 Developmental Disability Administration (DDA) licensed agencies participating in the Entity as ALR program and 542 people had opened accounts. These account owners were able to save almost $3 million for future wants and needs while maintaining their benefits.

Finally, 2020 brought back to ABLE account holders the use of the ABLE Visa Prepaid card. It’s a fabulous tool that lets people distribute ABLE assets to the card, purchase what they need, set a budget, track spending, and learn to manage their money.

Maryland ABLE is excited to help YOU invest and manage your money, achieve and maintain independence, and make 2021 your best year ever!

ABLE Update for People Who Work

Did you know that since ABLE to Work began, 228 beneficiaries have taken advantage of the increased annual contribution limit for working beneficiaries and contributed almost $700,000? If you are working and not yet contributing through the ABLE to Work benefit, make it your New Year’s resolution to join them! For 2021, the contribution limit has increased to $12,760. This is the amount that can be contributed in addition to the $15,000 standard annual contribution limit, if you or your employer are not also depositing into a retirement account for your benefit.

If you are unemployed and receiving unemployment benefits, you can deposit your unemployment benefit money into your ABLE account. If you have earned income for the calendar year, you can choose to mark those contributions as ABLE to Work up to the total ABLE to Work limit of $12,760. If you do not have any earned income for the current calendar year, you can still deposit your unemployment benefit money to your ABLE account but it will count towards your $15,000 annual standard annual contribution limit.

Remember, the Federal Pandemic Unemployment Compensation (FPUC) Supplemental amount added to the unemployment benefits, $300/week was extended through March 14, 2021 and additional federal relief may be coming. This additional unemployment benefit can also be deposited into you ABLE account.

Important Note: The additional unemployment benefit is counted as income for SSI purposes but does not count towards your earnings for the purposes of calculating the maximum ABLE to Work contribution amount.

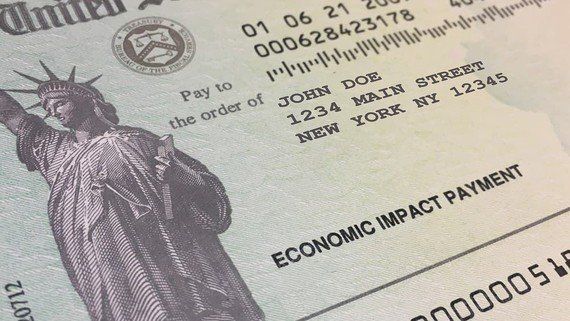

Stimulus Payments and ABLE Accounts

If you received or will receive a one-time stimulus payment, you may want to consider putting that money into your ABLE account, if you haven’t done so already. After 12 months, stimulus payment monies are considered an asset, and will count against the $2,000 asset limit for SSI. The first $100,000 in your ABLE account is excluded from the asset limit test. Contributing the money to your ABLE account, then, could allow you to use it for any Qualified Disability Expenses in the future while maintaining eligibility for your SSI benefits each month.

User's Guide - Coming Soon!

Through a grant from the Developmental Disabilities Council, “A Guide to Maryland ABLE” will be available soon! This guide was written to help people with disabilities and their families better understand Maryland ABLE, how to use it, and the benefits and costs of having an ABLE account. This guide was reviewed by people with disabilities, family members, and advocates to create a resource that is accessible to all. This guide will be available on the DD Council and Maryland ABLE websites, printed in English, Spanish and large print, and be available on a flash drive for people with visual impairments. Think of this resource as the Cliffs Notes guide to understanding your ABLE account! But remember, full details of the Maryland ABLE program are found in the Disclosure Statement.

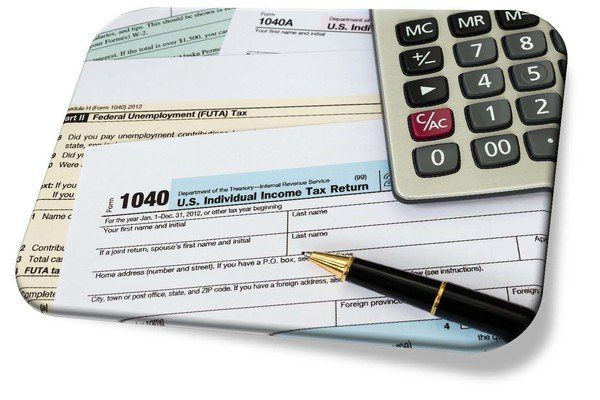

It's Tax Time Again!

As you prepare your 2020 income taxes, remember contributions to your Maryland ABLE account may be eligible for an income deduction. Maryland taxpayers have access to a Maryland State income deduction up to $2,500 per contributor, per beneficiary for contributions made to a Maryland ABLE account. This means that couples filing joint returns can claim an income deduction up to $5,000 for contributions made to a Maryland ABLE account!

It has come to our attention that a number of Maryland residents have opened ABLEnow accounts believing that they had opened Maryland ABLE accounts. ABLEnow accounts are Virginia-based ABLE accounts and contributors to ABLEnow accounts cannot apply ABLEnow contributions toward the income deduction on their Maryland State taxes. If you have an ABLEnow account and are a Maryland taxpayer wishing to take advantage of the Maryland income deduction for the next year, you may roll over your ABLEnow account to a Maryland ABLE account without cost or tax penalties. Contact our Customer Service at 1.855.563.2253 for assistance.New Paragraph